Amazon Seller Taxes: Master Tax Strategies in 2024

Amazon Seller Taxes: Master Tax Strategies in 2024

As an Amazon seller, maximizing your net profit requires smart tax planning and filing strategies. While you must remain fully compliant, there are legal ways to maximize deductions and minimize your burden for Amazon seller taxes.

Hello, fellow resellers and wantrepreneurs! This is Omer aka bookupcycle, I have sold over $10M worth of books on Amazon in 2023. In this blog post, I will explain 10 tips for filing tax for you Amazon reselling business.

How to File Taxes as an Amazon Seller with 10 helpful tips:

Disclaimer: I am not a tax professional. This information is for educational purposes only. Please consult a qualified tax specialist before implementing any strategies.

1. Hire a Qualified Tax Professional

Even if you have years of experience selling on Amazon, it’s still crucial to work with a tax expert. Partnering with a certified tax professional, such as a CPA or Enrolled Agent who specializes in e-commerce and online businesses, is essential when it comes to navigating the complexities of Amazon Seller taxes. They will be able to identify all potential deductions based on your unique sales model, expenses, revenue level, and growth plans. Trusting their expertise can result in significant savings on your tax bill that far outweigh their fees. Don’t underestimate the value of having an experienced tax expert by your side when it comes to managing your Amazon Seller taxes effectively.

2. Maintain Dedicated Business Accounts

However, using a single bank account for both personal and business finances can quickly become overwhelming, even if you meticulously track expenses across multiple spreadsheets. To simplify matters, it is a better practice to open a dedicated business checking account. Then, you can transfer funds from your personal account into the business account, and conduct all business-related expenditures from that separate account. By following this practice, it provides a clean audit trail that is essential for maximizing allowable deductions.

It establishes clear boundaries between your personal and professional finances, making it easier to manage taxes and financial reporting.

So if you’re still using your personal bank account for your Amazon tax transactions (or any other type of business), now might be the time to consider opening a dedicated business checking account. It’s an important step towards organizing your finances and ensuring compliance with tax regulations.

3. Optimize Your Business Entity for Amazon Seller Taxes

The most tax-efficient entity structure depends on your profit margins, personal situation, and future plans. A sole proprietorship or single-member LLC may suffice for lower earnings. However, an S-Corporation could provide sizable tax savings if profits exceed $50,000 to $100,000 annually after factoring in its higher tax compliance costs and stricter requirements. When considering whether to choose S Corp tax status for your business, it’s essential to weigh the benefits and drawbacks. Some advantages of an S corporation include not paying federal taxes at the corporate level and the ability to save on self-employment taxes. However, there are disadvantages such as eligibility restrictions, added administrative costs, impact on retirement plan contributions. Ultimately, the decision between an LLC and an S Corp depends on factors like the business’s financial situation, tax treatment preferences, and long-term goals.

4. How to get taxes information from Amazon Seller account?

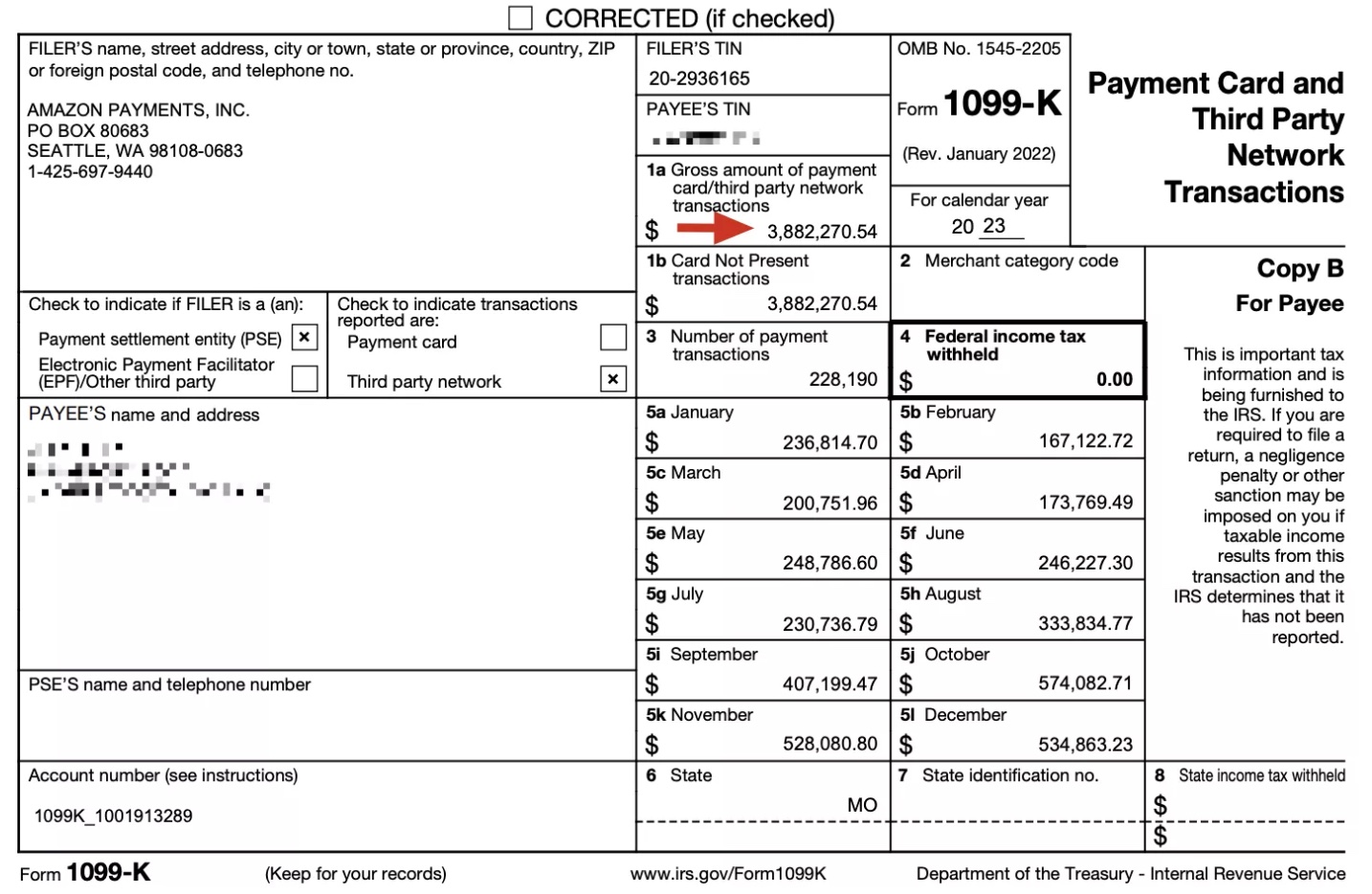

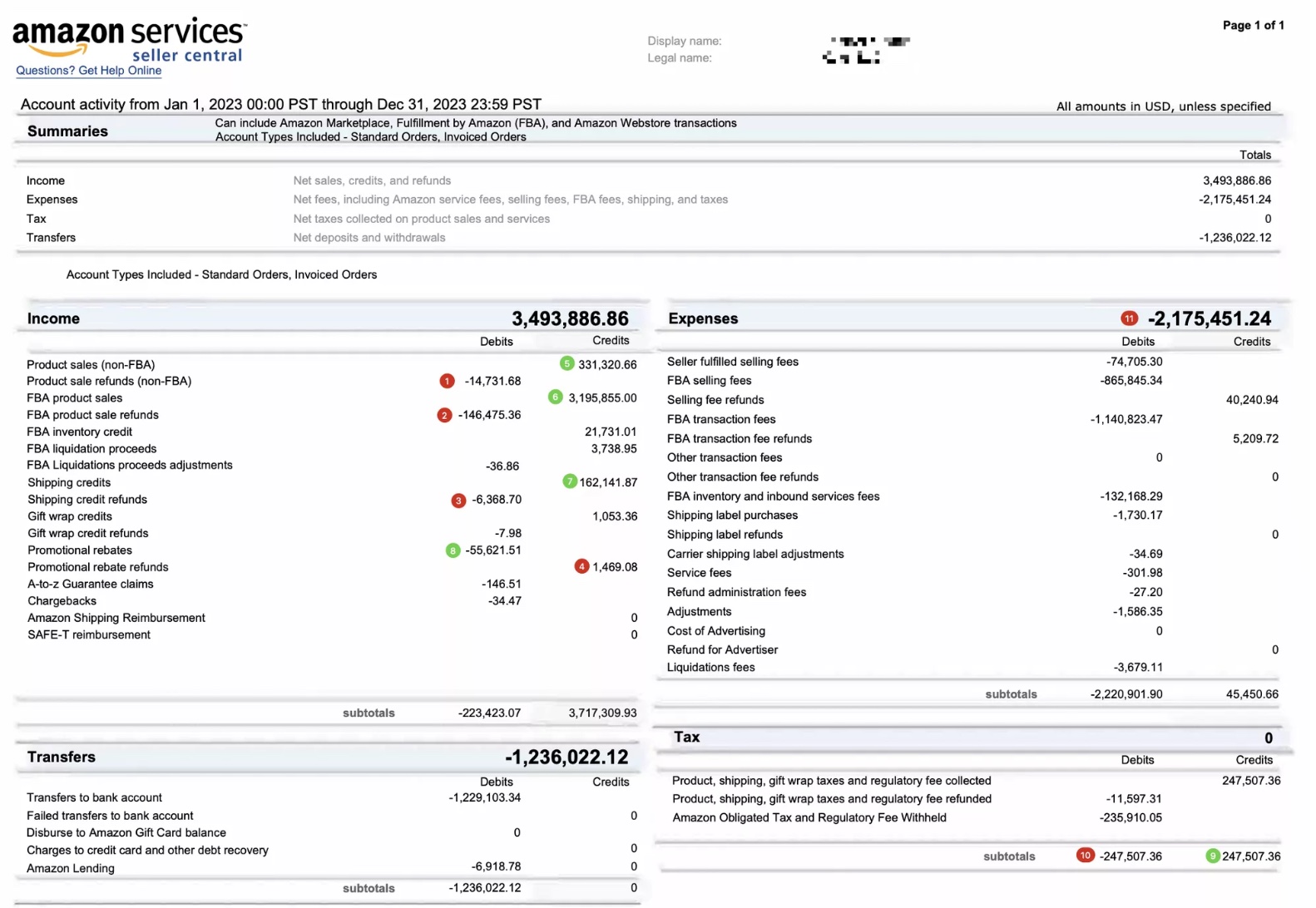

Your annual 1099-K from Amazon states your total sales revenue, which must be fully reported as business income. However, there are complications – e.g., delayed payouts from reserves or charge-backs can impact timing. Discuss these complexities with your tax professional.

There can be discrepancies between the 1099-K that Amazon generated and the actual payout you receive. You need to report the 1099-K top-line amount and other incomes you have. It is important to base your filing on the 1099-K unadjusted gross revenue. Amazon reports this income to the IRS, and you may not want to cause a discrepancy between what Amazon files and what you file as your Amazon revenue.

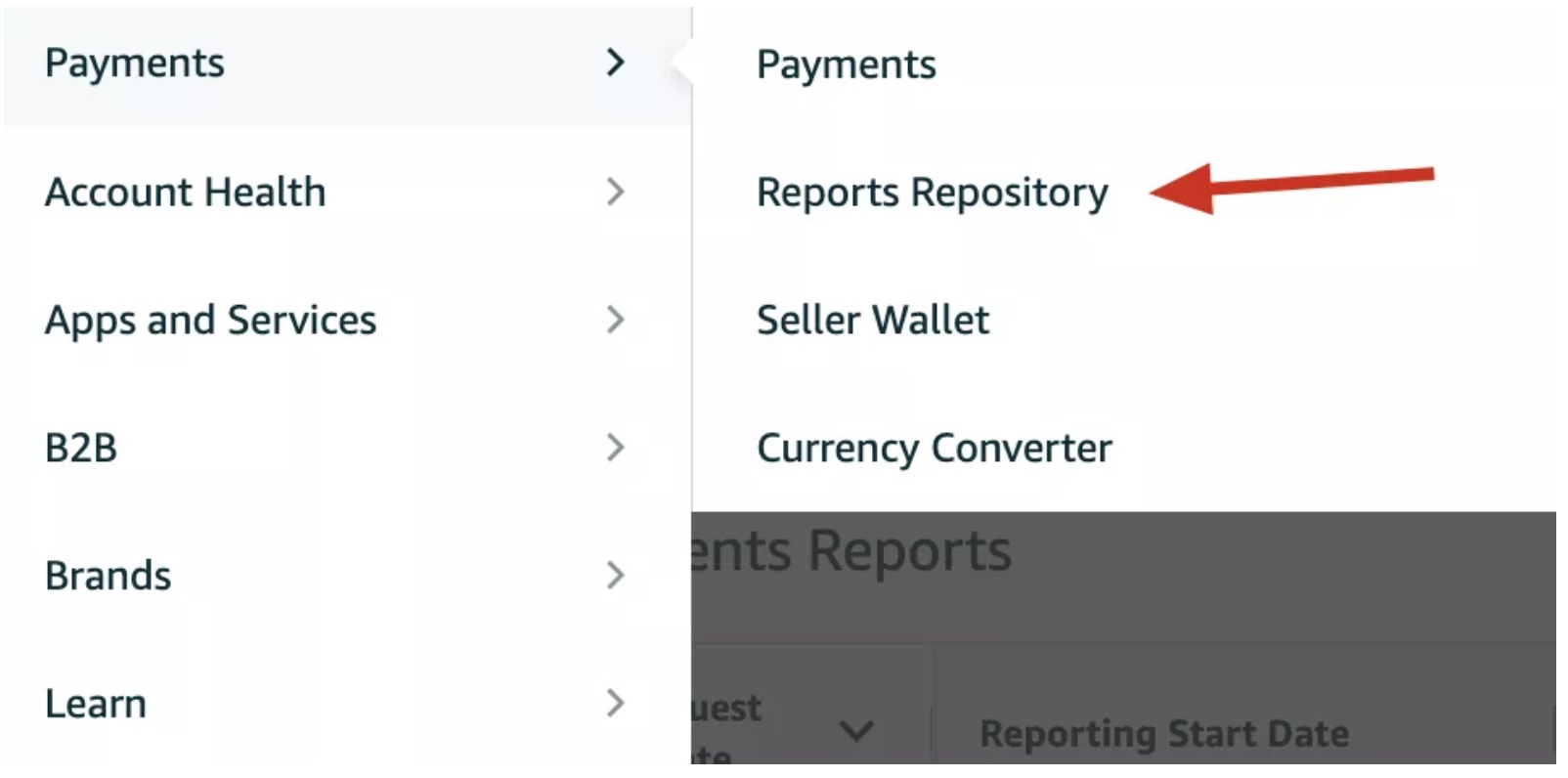

You can generate a summary date range report on Seller Central (in the Reports Repository) to see the Amazon-related expenses.

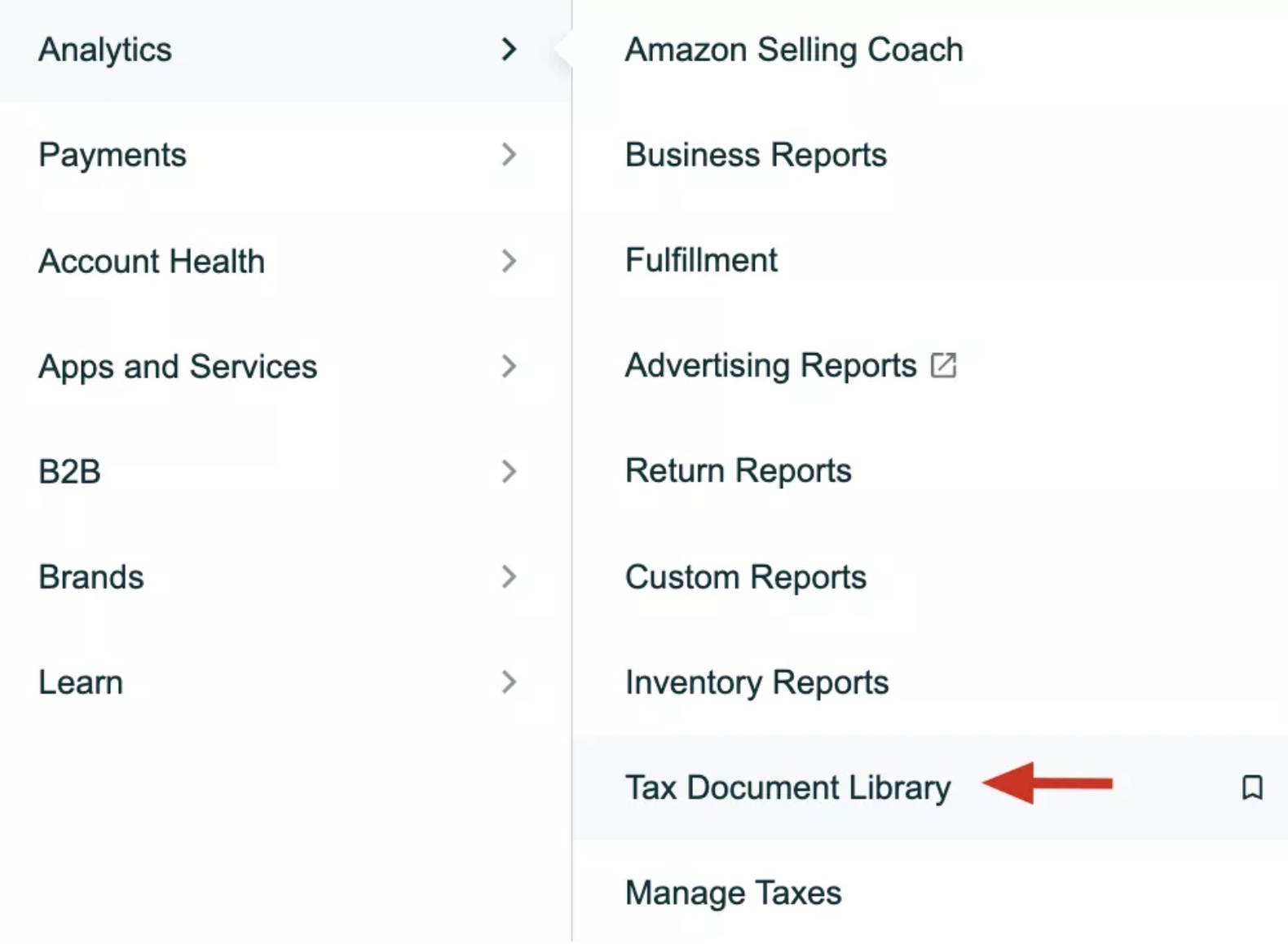

a. To obtain 1099K, go to “Tax Document Library” on Amazon Seller Central

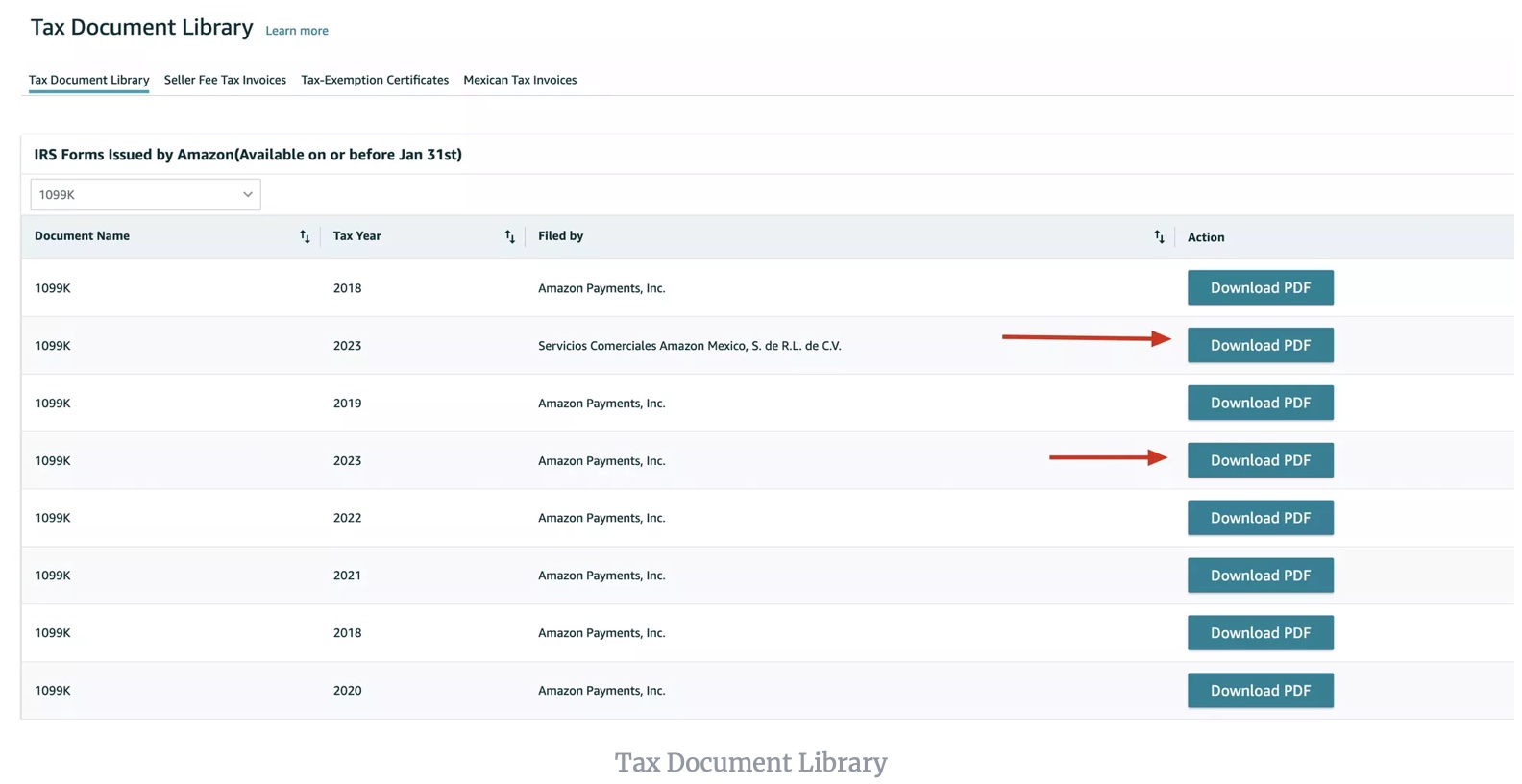

b. Download all the PDFs related to the year you are working on

Note: You may see multiple 1099Ks for the same year. The reason can be either selling on multiple marketplaces(Amazon US, MX etc.). or “Tax Identifier”(Employer Identification Number or Social Security Number) change during the year. Each 1099K should be reported with the EIN or SSN on it.

c. Consider the gross amount of payment which is shown on 1a as your Amazon top-line.

d. Go to “Payment Repository” on Amazon Seller Central

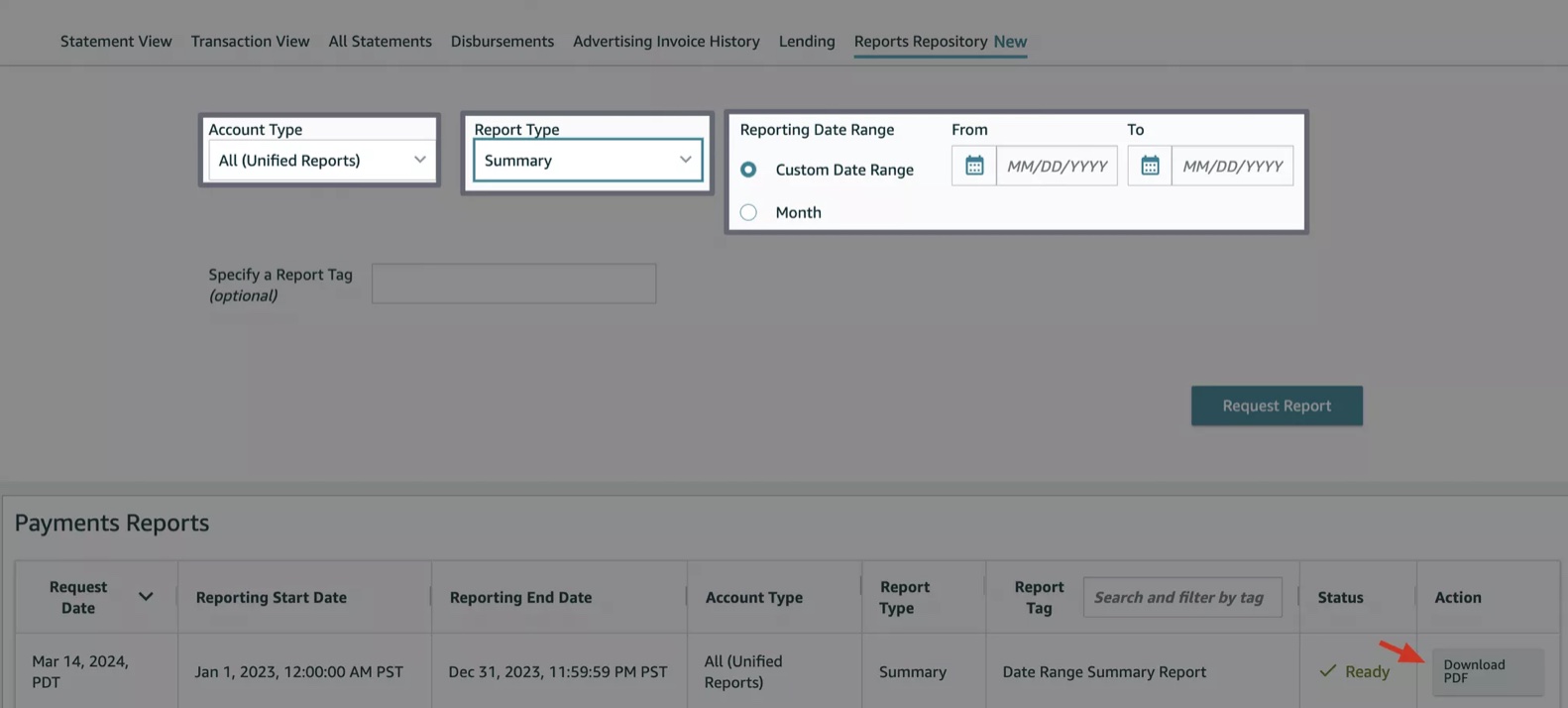

e. Generate a date range summary report for the desired year to file tax and download it

f. Check each category item on date range report

The top number on the date range report and the 1099K is different if you noticed. If you perform the following calculation, the final number should be very close to the amount on your 1099K.

Add the total of Product Sales + Product Sales Tax + Shipping Credits + Shipping Credits Tax + Gift Wrap + Gift Wrap Tax + Promotional Rebates + Promotional Rebates Tax for both Standard & Invoiced Orders (if applicable).

- Deduct Amazon related expenses from your top-line on 1099K

- Product sale refunds(non-FBA) shown as 1 in the previous screenshot

- Product sale refunds(FBA) shown as 2

- Shipping credit refunds shown as 3

- Promotional rebate refunds (notice that it is not negative so this is reverse)

- Sales tax (and other taxes) shown as 10

- Expense shown as 11

5. Deduct All Business Expenses

6. Calculate Cost of Goods Sold Accurately

For product re-sellers, accurately calculate your Cost of Goods Sold (COGS), which covers all “inventorial” costs to purchase/produce the items resold on Amazon – including product costs, freight inbound, packaging/labeling, storage fees, etc. Inventory valuation is critical for accurate COGS deductions.

For product manufacturers, COGS includes materials, factory labor, packaging, freight to the warehouse, and an allocable share of factory overhead costs. COGS is often the largest deduction for manufacturers.

7. Handle Contractor Taxes Properly

If you use contractors for tasks like product prep or inspections, make sure to issue them accurate annual 1099-NEC forms stating income paid from your business. Have them complete W-9 forms as well. Contractor labor is fully deductible but subject to information reporting requirements.

8. Capitalize Assets & Deduct Depreciation

For capital investments such as warehousing equipment, machinery, vehicles, computers etc., capitalize these assets and then deduct depreciation annually based on their prescribed cost recovery periods. Section 179 may allow full expensing in some cases.

9. Implement Year-End Tax Planning Strategies

In December each year:

- Make deductible purchases like shipping supplies and tools that you’ll need in the following year.

- Prepay other expenses such as insurance premiums and contractor costs.

- Consider subscribing to software services for next year.

- If possible within your financial means and growth plans: make significant equipment or asset purchases to maximize bonus depreciation.

These strategies can help boost deductions for the current tax year.

10. Don't Overpay But Remain Compliant

While it’s important to fully report all income and pay all taxes legitimately owed, it’s equally important not to leave money on the table. Proper tax planning, maximizing deductions, and taking advantage of all credits and deductions allowed by the IRS will keep more of your hard-earned profits in your Amazon business.

Work closely with your qualified tax professional throughout the year to understand how to implement these strategies based on your specific Amazon sales model, expenses, profit levels, growth plans, and more. With meticulous record-keeping and guidance, you can maximize tax savings while remaining fully IRS compliant.

Remember: Taxes can be complex and subject to change. Stay informed about any updates or changes in tax laws that may affect your Amazon business. By staying proactive and working with a qualified professional, you’ll be well-positioned to navigate the ever-changing landscape of Amazon seller taxation.

Note: The information provided here is for educational purposes only and should not be considered as legal or financial advice. Always consult with a qualified tax specialist before making any decisions regarding your taxes.

Bonus: Amazon Seller Taxes Terms

Even though a tax expert may be more familiar with financial matters than you are, it’s still important for you to understand the accounting aspects of your business. Your guidance is crucial because you know your business, its goals, and your cash flow situation better than your accountant does. That’s why you need to become familiar with some terms related to filing taxes as an Amazon seller.

Profit and Loss Statement or PnL

A Profit and Loss (P&L) statement, also known as an income statement, is a financial document that summarizes a company’s revenues, costs, expenses, and profits or losses over a specific period, typically one year. It provides crucial insights into a company’s financial performance by detailing the income generated and the expenses incurred during that time frame. The formula for calculating profit or loss on a P&L statement is Revenue – Expenses = Profit or Loss. This statement is essential for business owners as it helps assess profitability, make informed decisions, identify areas for cost-cutting, and understand the overall financial health of the business.

Deductions

Tax deductions for Amazon sellers are expenses that can be subtracted from your taxable income, reducing the amount of taxes owed. Common deductions include COGS, FBA fees, home office expenses, supplies, professional development, and travel costs. Keeping detailed records is crucial for maximizing deductions and consulting a tax professional is recommended for personalized guidance. Example categories of expenses are shown in the previous screenshot as deductions to be subtracted from your top-line or gross revenue.

Taxable Income

Taxable income is the amount remaining after deducting eligible business expenses, such as cost of goods sold, Amazon FBA fees, and other operational costs. Properly calculating and reporting your taxable income is crucial to ensure you pay the correct amount of taxes and remain compliant. Consulting a tax professional can help Amazon sellers understand what qualifies as taxable income and ensure they are meeting all tax obligations.

Milage Reimbursement

It allows Amazon sellers to deduct a portion of vehicle expenses for business-related driving, such as sourcing products. The current IRS rate is $0.67 per mile in 2024. For example, if you drive 1,000 miles to visit local stores, you can deduct $670 as a business expense, reducing your taxable income. Proper record-keeping is crucial for claiming this deduction. I would recommend using an app like MileIQ to track down the miles drown for business or using a separate vehicle for the business.

Tax Bracket

For tax payers, the “tax bracket” refers to the range of taxable income that determines the federal income tax rate you pay. The higher your taxable income, the higher the tax rate you’ll owe.

In the U.S. tax system, income is taxed progressively, meaning different portions are taxed at varying rates within your applicable brackets, not at a singular rate based on your highest bracket. For example, if you’re a single filer whose Amazon business earns $60,000 in taxable income in 2023, your tax is calculated by applying the relevant rates to income segments within each bracket: 10% on the first portion, 12% on the next, and 22% on the remainder up to $60,000. This ensures only the income exceeding each threshold is taxed at the higher rate, leading to a lower effective tax rate across your total income. Understanding this progressive taxation is vital for accurate financial planning and estimating tax liability. Consulting a tax professional can further clarify your specific situation, ensuring compliance and optimization of tax benefits.

Conclusion

In conclusion, as an Amazon seller, it is crucial to prioritize smart tax planning and filing strategies to maximize your net profit. By hiring a skilled tax professional, you can ensure that your Amazon seller taxes are handled correctly. It’s important to maintain separate business accounts for your Amazon earnings. Optimizing your business entity structure is another key step in managing your taxes effectively. Make sure to accurately report all revenue generated from your Amazon sales. Deducting eligible expenses is crucial in reducing your overall tax liability. Finally, staying compliant with tax regulations without overpaying is essential for navigating the complexities of Amazon seller taxes successfully. Remember to consult with a qualified tax specialist for personalized advice and stay informed about any changes in tax laws that may affect your Amazon business. With strategic planning and guidance from professionals, you can effectively manage your taxes while maximizing your profits.

Lastly, Bookz Pro offers a variety of software products for Amazon sellers, including an analytics dashboard, listing software, repricer, mobile application for scouting books, and inventory manager. Get a demo today, and we will help you streamline operations and increase revenue.

In addition, we have created a free eBook called “Amazon Book Reselling Blueprint” that you can download. If you are a bookseller on Amazon, you may find our all-in-one software for book sellers helpful.

Amazon Book Reselling Blueprint

Read now, explore our full guide. Your revolution starts here. Subscribe to get the blueprint!