All About Amazon Restocking Fee: A 2024 Guide for Sellers

Introduction

Handling returns can be difficult and demanding for any Amazon seller. Although returns are inevitable, the cost of replenishing can significantly impact your sales. It can be very frustrating.

Keep in mind that you are not the only one dealing with this issue and you can still have a lot of ways to work on it. Furthermore, you need to note that there is a risk of potential loss if you are unaware of Amazon’s policies and regulations, particularly those regarding restocking fees.

This guide will help you understand restocking fees and how you can manage them effectively.

What is Restocking Fee?

When buyers return an item on Amazon, they may receive a partial refund due to a restocking fee. Customers may have to pay this fee, which is deducted from their refund. This depends on the condition of the returned item and the return policy terms.

The restocking fee is a fee Amazon sellers can charge in certain return situations. The fee amount depends on the original item cost, the reason for return, and the item’s condition when returned.

Return processing activities that typically result in expenses include:

- Setting up return shipping procedures

- Receiving, handling, and inspecting returned items

- Reboxing, cleaning, and repackaging items for resale

- Updating inventory counts across channels

- Relisting items for sale

Amazon allows sellers to charge restocking fees in some cases to cover return handling costs but also limits or bans fees in certain situations to protect buyer rights.

How Does Restocking Fee Work?

Amazon generally allows customers to return items within 30 days for a full refund if the items are in original condition.

However, sellers can charge a restocking fee in certain cases:

- If the item is returned after the 30-day window.

- If the returned item differs from the original, is worn, or damaged

- Sellers must initiate the restocking fee process within 2 days of receiving the return request.

Sellers should understand the specifics of when they can and cannot charge a restocking fee, to both satisfy customers, comply with Amazon’s policies and protect their margins.

How Much is the Amazon Restocking Fee?

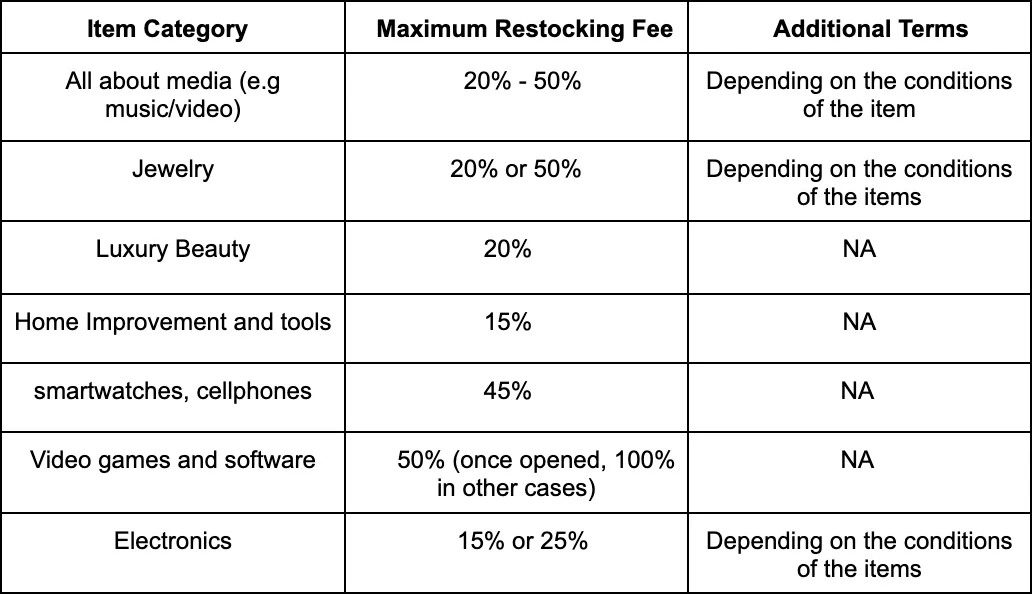

For items sold by third-party sellers on Amazon, restocking fees have more flexibility but must stay within the limits set by Amazon. The final fee can vary based on:

- Product Category: Some types, like jewelry, may have higher fees due to more intensive inspection requirements.

- Reason for Return: If outside the seller’s policies, a higher fee may apply.

- Amazon Prime Membership: Prime customers often get protection from restocking fees.

For example, potential restocking fee ranges for different Amazon product categories are:

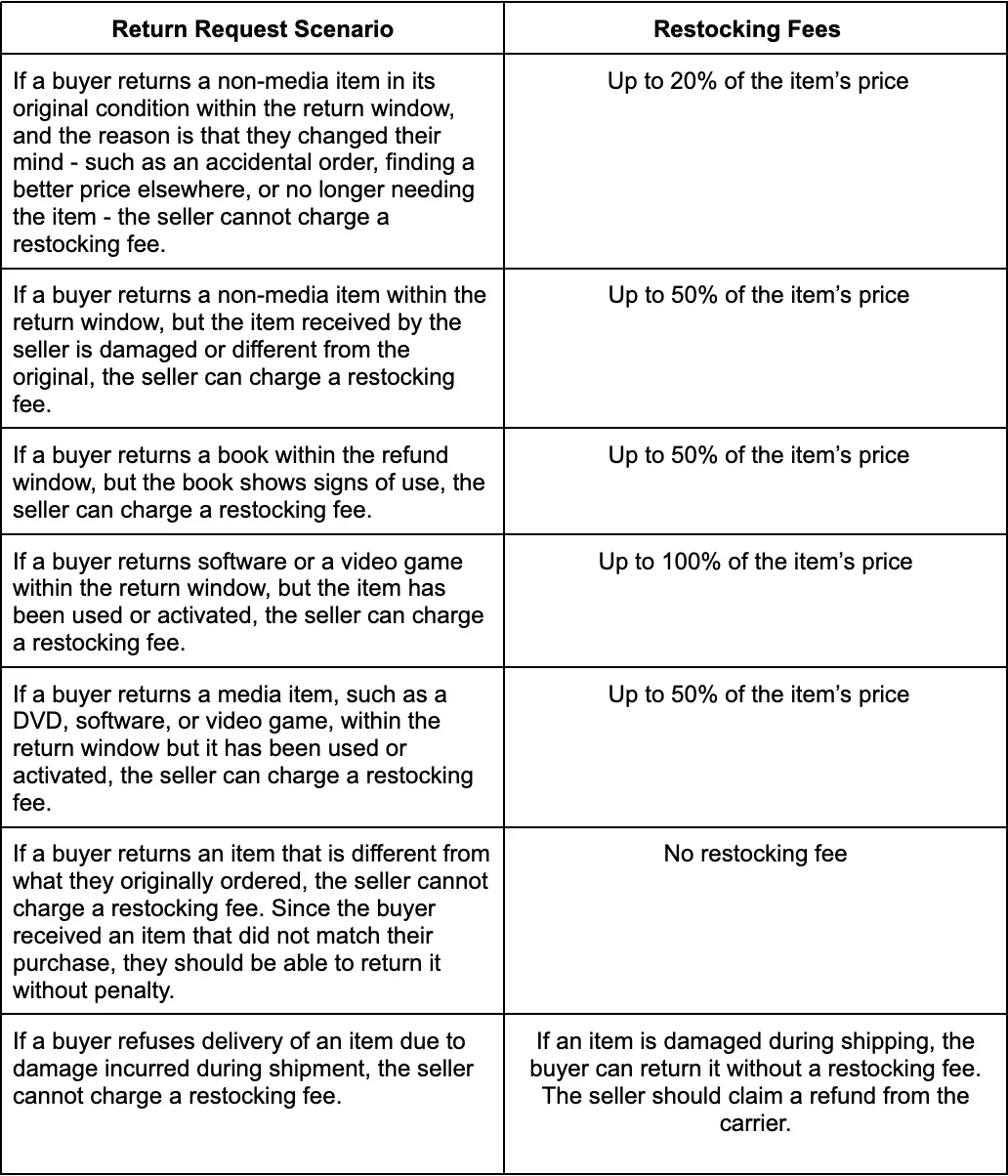

The following chart shows how to calculate refund fees for various return situations:

Amazon’s Restocking Fee Policy Explained

As an Amazon seller, understand the restocking fee policy – buyers may pay a fee based on an item’s original price and condition when returning it.

When a buyer returns an item:

- The buyer starts the return process and sends the item back.

- The seller checks if a restocking fee applies based on Amazon’s policies.

- If eligible, the seller charges the restocking fee.

- Amazon then refunds the remaining amount to the buyer.

Understanding the restocking fee policy is key for sellers to properly manage the returns process.

When Amazon sellers can charge restocking fees:

- The returned item shows clear signs of use or damage

- The item falls under certain product categories, like electronics or luxury goods.

- The stated reason for the return does not match.

Even when a seller is contractually allowed to charge a restocking fee, they still have the discretion to waive the fee on a case-by-case basis, if they feel it will enhance customer satisfaction.

When Sellers Cannot Charge Restocking Fees:

- The buyer has an active Amazon prime subscription and it is a prime order.

- The returned item arrives damaged, defective, or materially different from the original listing

- The product category, such as books, prohibits charging restocking fees

Sellers need to assess each return request to determine if a restocking fee can be charged, rather than automatically assuming fee eligibility.

How Does Return Policy Affect Amazon Sellers?

As of May 2024, Amazon employees would inspect returned FBA items to determine if they were sellable. Now, sellers have new options:

- Leave returns evaluation on

- Turn returns evaluation off

- Selectively apply returns evaluation by ASIN

This gives sellers more control over how returned items are handled, helping to avoid issues like customers receiving damaged products. If you sell products that often get damaged during returns or have many moving parts/electronics, this update is beneficial. Now, you can evaluate the returned items yourself, instead of relying on Amazon. This gives you more control over managing your inventory.

Moreover, as an Amazon seller, you can charge a restocking fee for returned items. The cost is a percentage of the original price, which varies according to the item type and condition. Understanding and following restocking fee regulations can help sellers handle returns.

As an Amazon seller, you can:

- Determine Eligibility: Charge restocking fees for eligible items like electronics, jewelry, and watches, but not for books, music, or video games.

- Calculate the Restocking Fee: The fee is a percentage of the item price, based on Amazon’s guidelines.

- Issue a Partial Refund: Deduct the restocking fee from the customer’s refund using Amazon’s tool.

- Communicate the Restocking Fee: Inform customers of the fee upfront in your item descriptions or store policies.

- Be Consistent: Apply the same restocking fee for similar items and conditions to avoid confusion.

Explore Flexible Pricing Solutions with Bookz Pro

Staying competitive as an Amazon seller is crucial, and Bookz Pro can help you achieve that. This flexible and intelligent automated repricer gives you a powerful edge in the marketplace.

Bookz Pro offers more than just repricing. It includes listing software and an inventory manager, providing a comprehensive suite of tools to streamline your Amazon business.

Don’t let the competition outpace you. Enjoy top-notch features at Bookz Pro today and take control of your Amazon success. There is no installation fee and 14 day free trial.

Conclusion

Understanding the restocking charge policy is essential for profitability and compliance as an Amazon seller in 2024.

Certain things are subject to fees, while others are not. The charge is a percentage determined by Amazon’s policies. Utilize their resources to provide partial refunds.

Make sure to apply the fee uniformly and communicate it. By doing this, you safeguard your margins and win over customers. You may succeed as an Amazon seller by keeping up with the latest trends and changing your tactics.

Frequently Asked Questions

Yes. Amazon may charge a restocking fee for returns depending on the return reason. Third-party sellers on the Amazon platform have restocking fee structures, but they must adhere to set limits.

Typically, a restocking fee is not required if the item being returned is defective. The retailer is responsible for any damages or missing components, while you are not.

Amazon’s restocking fee is based on the item cost. The fee can range from 20% to 100%, but most cases allow up to 50%.

The restocking fee varies based on factors like product value, return reason, business policy, and profit margin. A typical restocking fee is 10-25% of the purchase price.