Amazon FBA Fees in 2024: A Comprehensive Guide for Sellers

Introduction

Amazon’s fees can be confusing, but understanding them is key to your success as a seller. Don’t worry—learning about these costs is easier than you think and will help you boost your profits. You will learn about a range of fees, including storage, packing, and shipping. If you’re part of the FBA program, you can gain the Prime badge, making your products more attractive to customers.

However, you can’t avoid referral fees, fulfillment fees, storage fees, and long-term storage fees for items you plan to hold onto. These fees are a reality when selling on Amazon.

Despite these costs, the incredible convenience and massive customer base on Amazon still make FBA a great online business opportunity. The key is determining whether your business will be profitable after accounting for all the necessary expenses.

Understanding these Amazon fees can help you make informed decisions and ensure the long-term profitability of your selling venture.

Understanding New Amazon FBA Pricing

Amazon has recently updated its fee structure, affecting referral fees, fulfillment fees, inventory fees, placement fees, and storage fees.

Over the past two decades, Amazon has steadily increased its FBA fees, reflecting the growing complexity and operational costs of its fulfillment services. Here’s a summary of the key changes:

- 2000: Amazon 3P Marketplace launched

- 2006: Amazon FBA launched with initial fees

- 2014: First major FBA fee increases

- 2015: FBA used by 50% of Amazon sellers

- 2017: Q4 storage fees increased by 300%, media selling fees up 50-75%

- 2018: Dimensional weight increased by 20%

- 2019: Reduced referral fees for products under $10, lowered per-item minimum

- 2020: Inventory disposal fee matched FBA removal fee

- 2022: Moved to dimensional weight, whichever is higher

- 2023: Introduced storage utilization and overage fees, low inventory fee

- 2024: Inbound placement fee, high return product fee

The cumulative impact of these changes has significantly increased the cost of selling on Amazon FBA, requiring sellers to optimize their operations, inventory management, and pricing strategies to maintain profitability. Staying on top of these fee updates is crucial for the success of any Amazon business.

Different Fees That Amazon Sellers Are Paying

As an Amazon seller, you must navigate a complex web of fees, from referral fees to fulfillment charges, and storage costs to high-volume listing fees.

Understanding these fees is crucial for maintaining profitability and making informed decisions about your Amazon selling strategy.

FBA Fees

If you’re an Amazon seller utilizing the Fulfillment by Amazon (FBA) program, you’ll need to navigate a complex web of fees. From storage and processing to shipping, the costs can quickly add up if you’re not careful.

The good news is that by understanding these FBA fees and implementing smart inventory and shipping strategies, you can significantly reduce your expenses and boost your overall profitability.

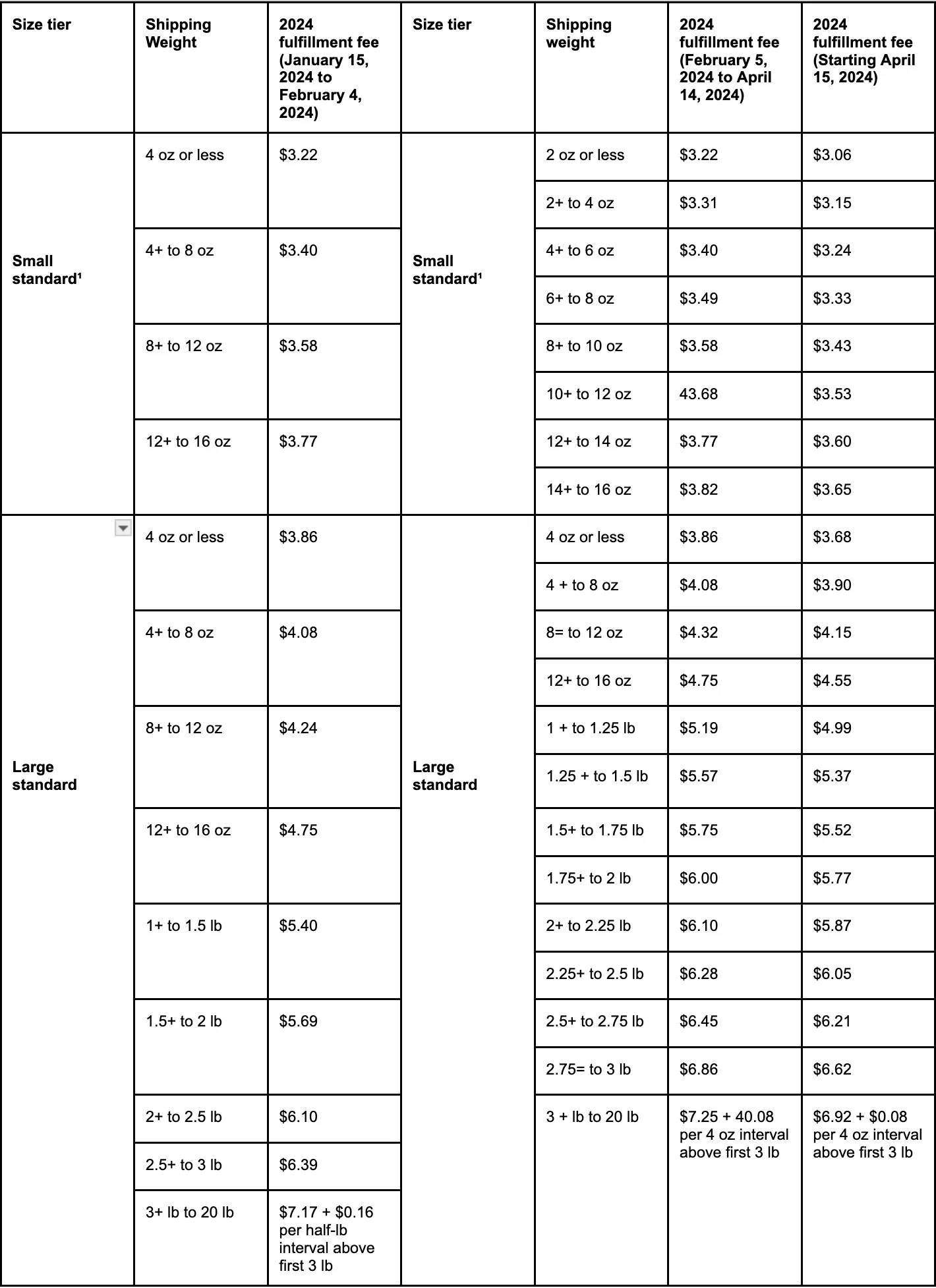

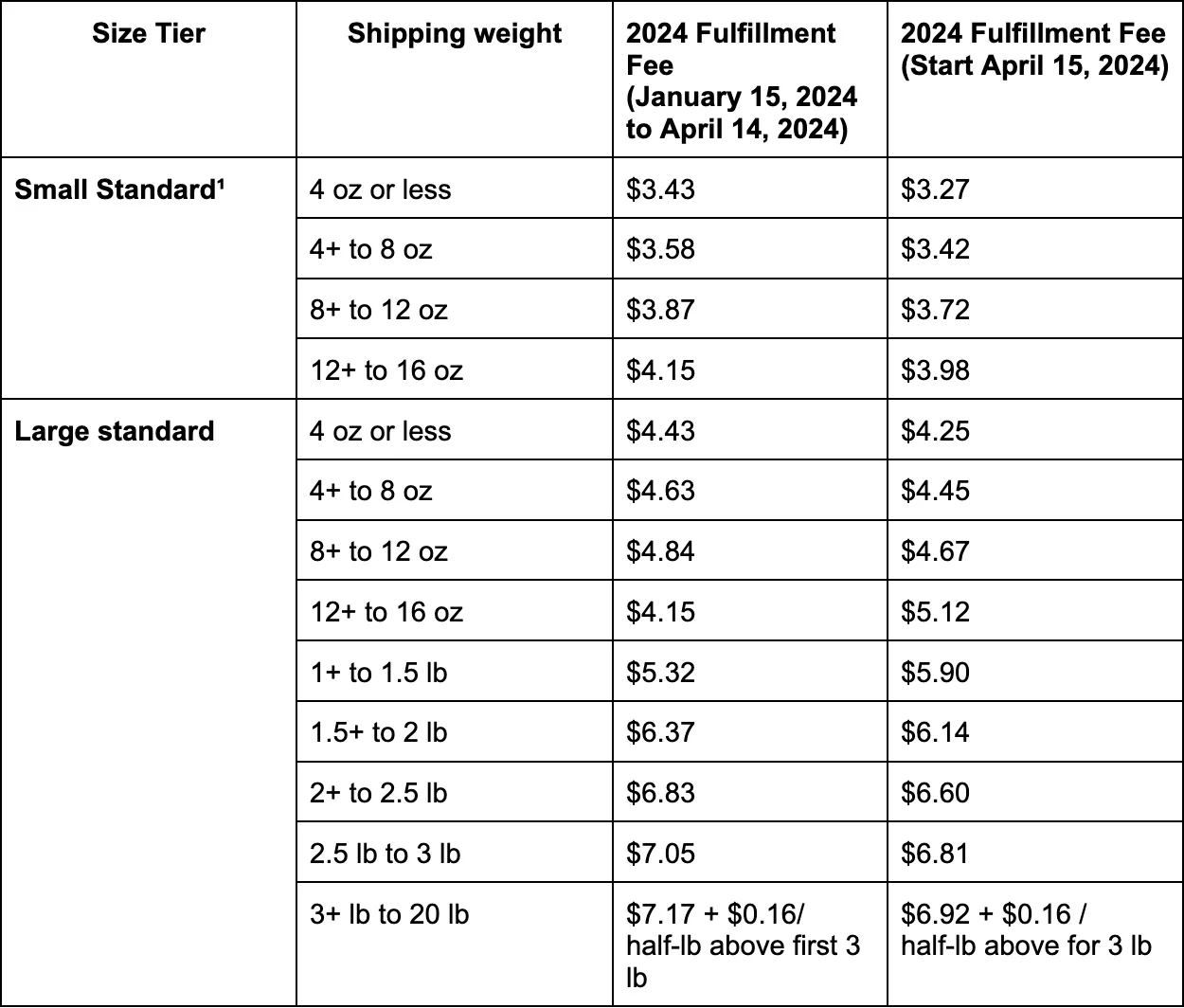

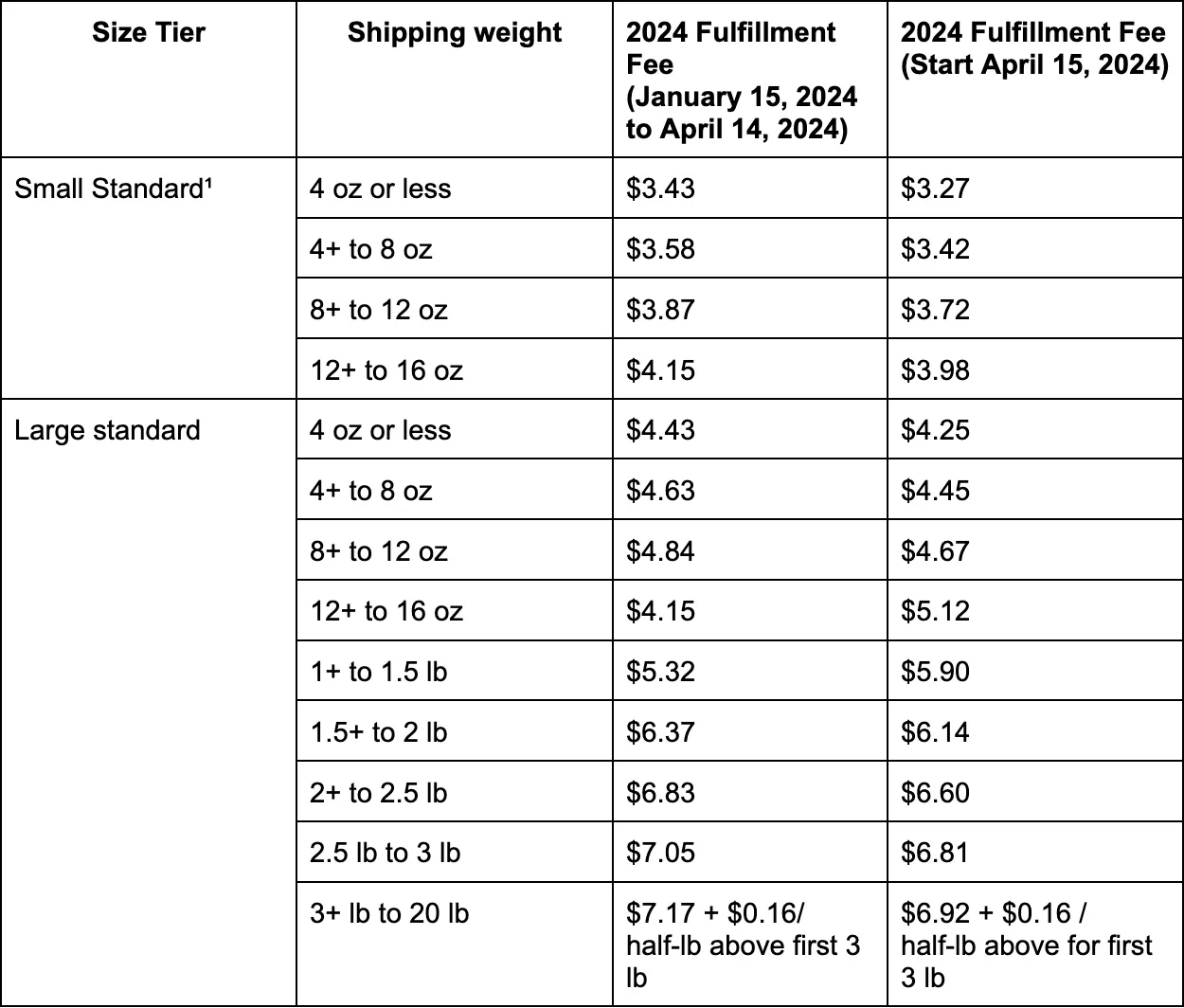

1. Standard-size non-apparel rates.

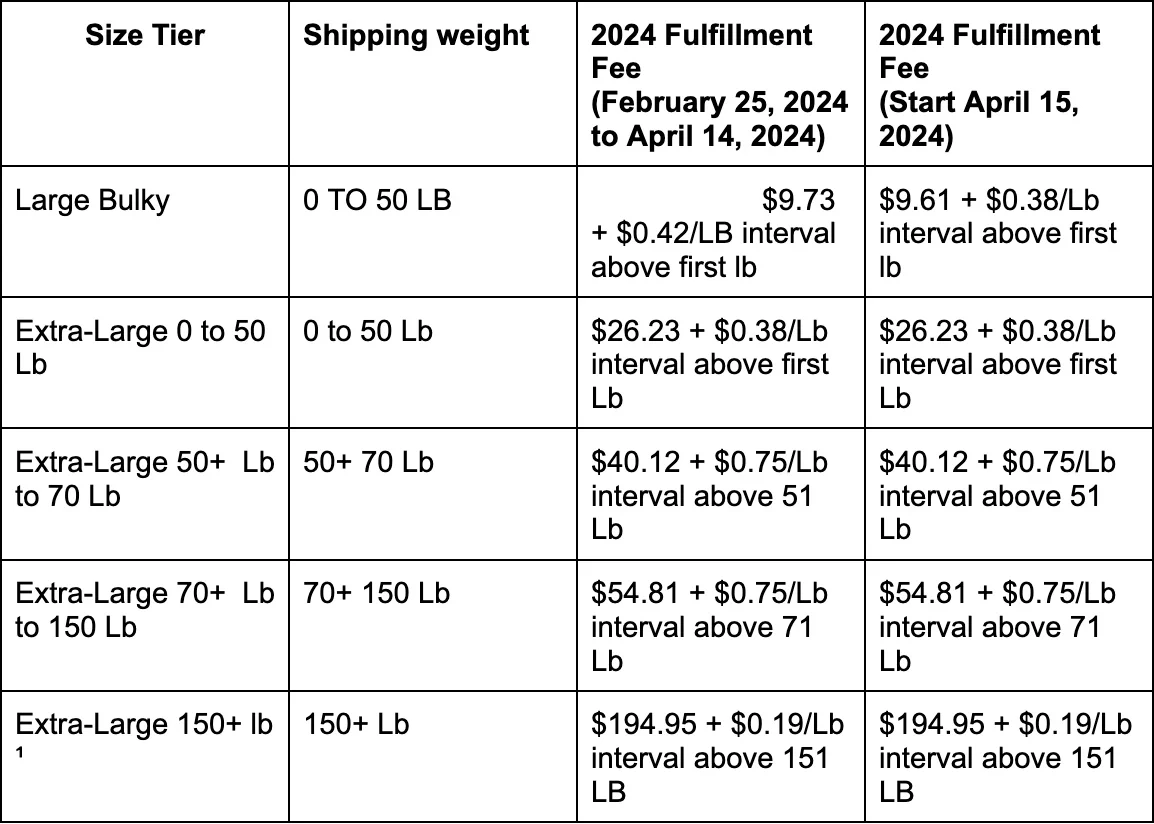

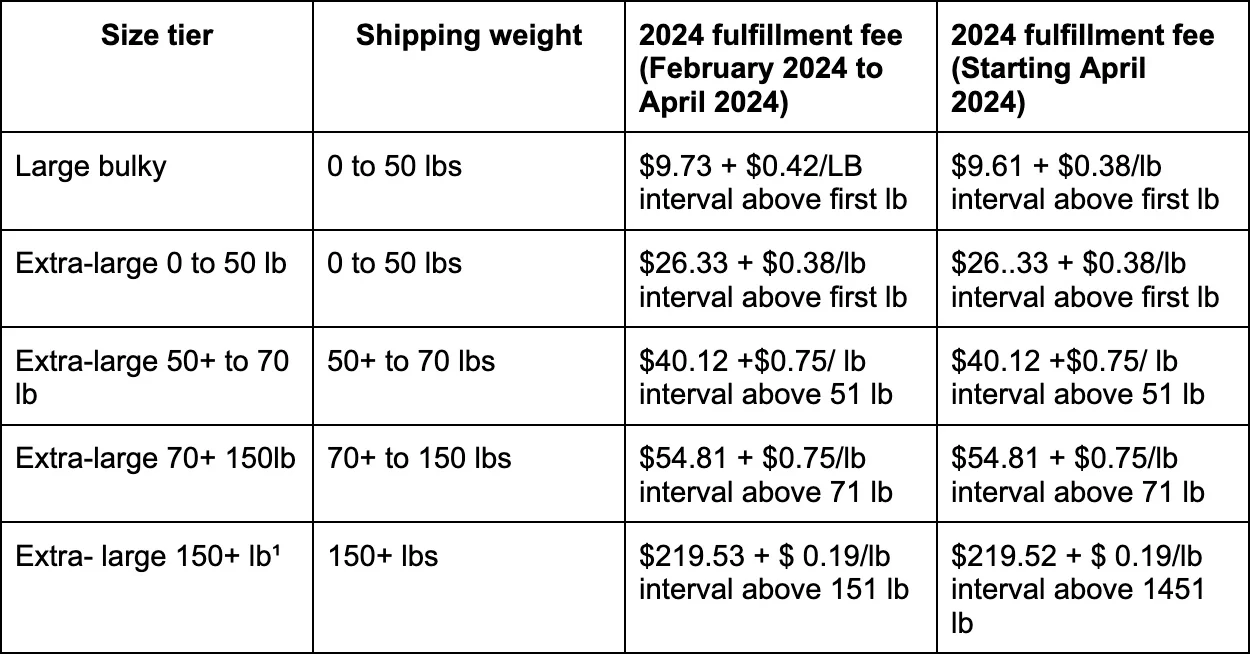

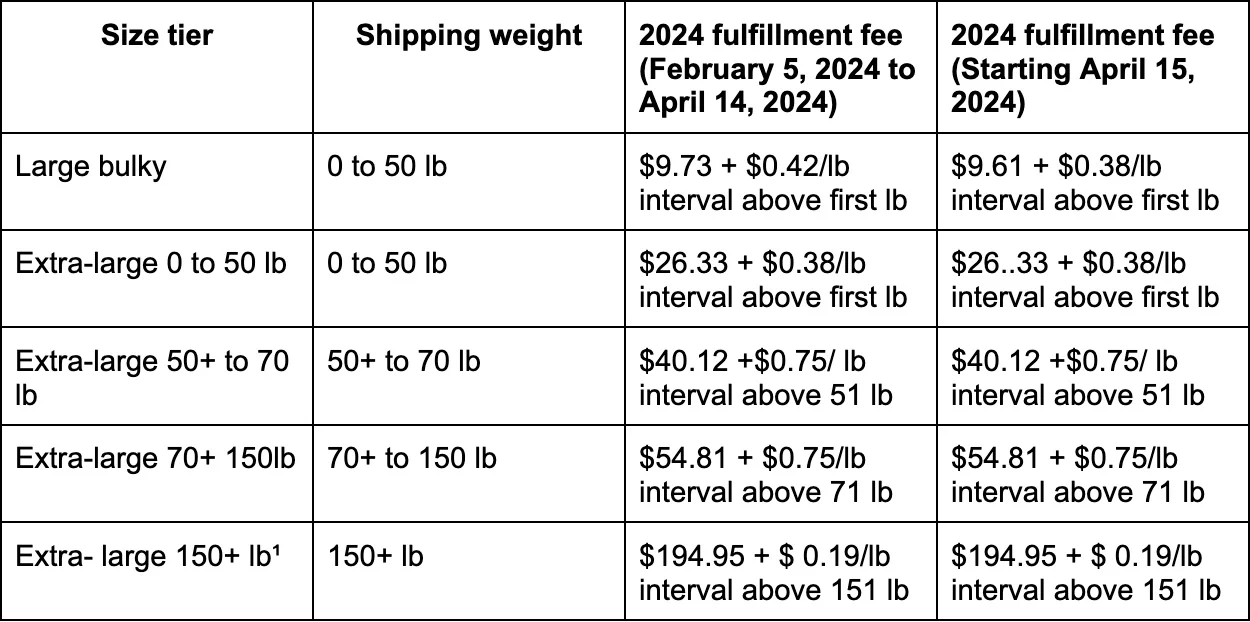

2. Non-standard-size non-apparel rates.

3. Standard-size apparel rates.

4. Non-standard-size apparel rates.

5. Standard-size dangerous goods rates.

6. Non-standard-size dangerous goods rates.

FBA inbound placement service fees

Amazon charges an FBA Inbound Placement Service Fee for distributing your inventory to specific Amazon fulfillment centers located close to customers. This fee was introduced on March 1, 2024.

Fee Options

Amazon provides two options for the FBA Inbound Placement Service Fee:

- Standard Placement: This is the default option, and Amazon will distribute your inventory to fulfillment centers based on their standard placement algorithm.

- Specialized Placement: With this option, you can specify the fulfillment centers where you want your inventory stored. This provides you with more control over inventory placement, but it may incur a higher fee.

The specific fee amount will depend on the option you choose and the size/weight of your products. It’s important to understand these fee options and choose the one that best fits your business needs and inventory management strategy.

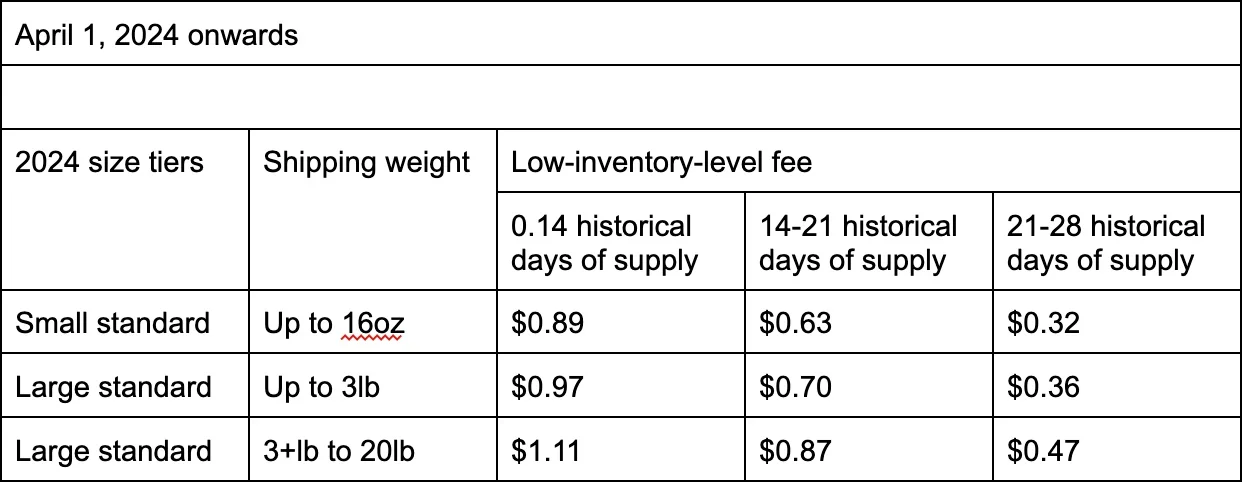

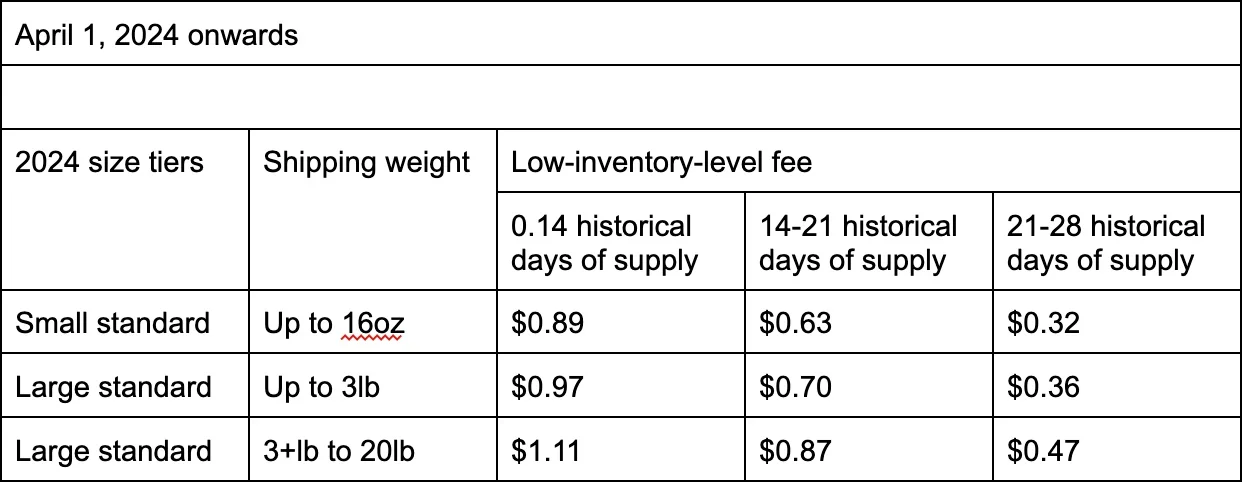

Low-level inventory fees

Effective April 1, 2024, Amazon will introduce a new low-level inventory fee that will apply to standard-sized products with consistently low inventory relative to customer demand.

When sellers carry low inventory relative to unit sales, it hinders Amazon’s ability to distribute products across their network. This degradation in distribution efficiency leads to slower delivery speeds and increased shipping costs for Amazon.

The low-inventory-level fee will only apply if a product’s inventory levels relative to historical demand (known as historical days of supply) are below 28 days. Amazon will only charge this fee when both the long-term historical days of supply (last 90 days) and short-term historical days of supply (last 30 days) are below 28 days (4 weeks).

For example, if a product’s short-term historical days of supply are above 28 days but long-term historical days of supply are below 28 days, the low-inventory-level fee won’t apply. Amazon will calculate the historical days of supply metric at the parent-product level and add the low inventory-level fee to the FBA fulfillment fee for all shipped units of eligible products.

Returns processing fees

Starting June 1, 2024, Amazon will charge a returns processing fee for products with high return rates.

- The return rate is calculated as a percentage of returned items compared to the total number of items shipped over a 3-month period.

- If the return rate for a product exceeds a certain threshold set by Amazon for that product category, the returns processing fee will apply.

- This fee applies to all product categories except apparel and shoes. For those categories, the fee will be charged for each individual customer-returned unit.

The returns processing fee is Amazon’s way of covering the costs associated with handling and processing high volumes of returned products. This fee encourages sellers to optimize their product listings and quality to reduce unnecessary returns.

Inbound defect fees

If the shipments you send to Amazon’s fulfillment centers do not meet the FBA shipment requirements or differ from your original shipping plan, Amazon will charge you inbound defect fees.

These fees cover the extra costs Amazon incurs for:

- Redirecting your shipment

- Receiving your shipment

- Processing your shipment

The inbound defect fees are designed to encourage sellers to follow Amazon’s FBA shipment guidelines and stick to their planned shipping details. This helps Amazon efficiently manage its fulfillment centers and provide the best customer experience.

By avoiding these inbound defect fees, sellers can save money and ensure their products get to Amazon’s warehouses smoothly.

Amazon’s Ships in Product Packaging (SIPP) Discount

The SIPP program allows sellers to ship their products to customers using their own brand packaging instead of Amazon’s. This can improve the customer experience and potentially boost sales.

To encourage the use of SIPP, Amazon offers a fulfillment fee discount ranging from $0.04 to $1.32 per item, depending on the size and weight of the product. By taking advantage of the SIPP discount, sellers can save money on fulfillment costs while also providing a more personalized experience for their customers.

Sales Fee

When selling on Amazon, you must be aware of a few key fees. The two main sales fees are Referral Fees and Closing Fees, which are charged on each item you sell. The exact amount of these fees can vary depending on the product category you’re selling in, so it’s important to understand the specific costs.

Referral Fees are charged as a percentage of the sale price while Closing Fees are a fixed amount per transaction. The Administration Fee is also a fixed fee that applies to returned orders. By familiarizing yourself with these Amazon sales fees, you can better plan your pricing and profit margins to maximize your earnings on the platform.

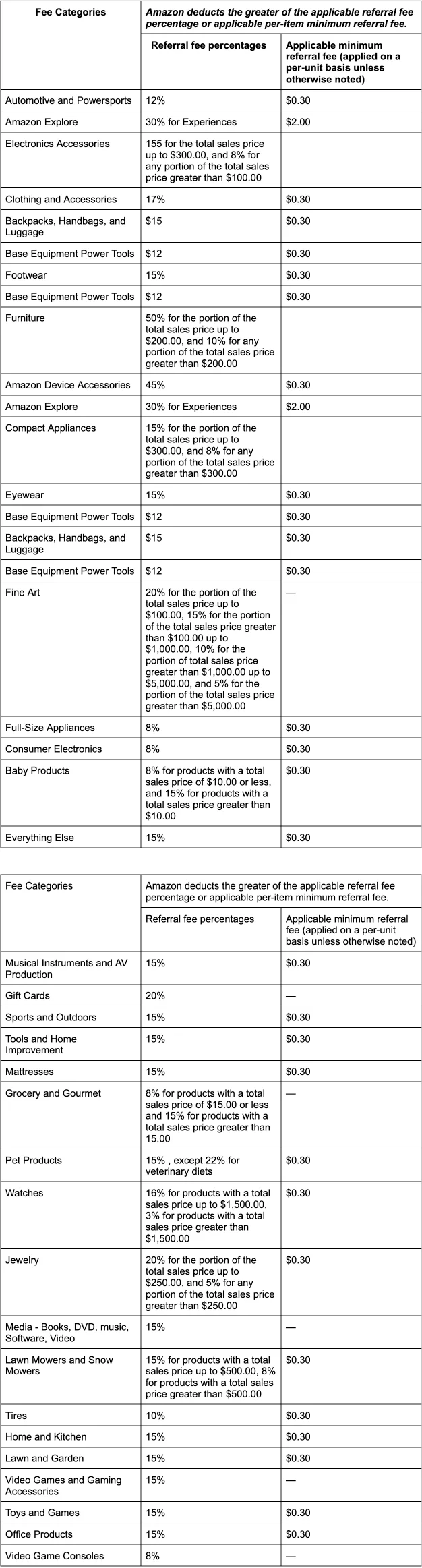

Referral Fee

The referral fee is the commission Amazon charges sellers for every item sold on its platform. Depending on the product category, this fee can range from as low as 6% to as high as 45% of the total sale price.

For media products specifically, the referral fee is calculated as 15% of the total sales price, not just the item price alone.

It’s important to note that Amazon recently made changes to referral fees for the apparel category:

- As of January 15, 2024, referral fees for apparel products priced under $20 have been reduced.

- For items priced under $15, the referral fee has decreased from 17% to 5%.

- The referral fee has been lowered from 17% to 10% for products priced between $15 and $20.

To help sellers understand the current referral fee structure, we’ve included a table below with the updated rates for various product categories.

Closing Fee

In addition to the referral fee, Amazon sellers will be charged a closing fee when selling products in certain media categories. This closing fee is a flat rate of $1.80 and is applied on top of the referral fee for items in the following media categories:

- Books

- DVDs

- Music

- Software (including video games)

- Video

- Video game consoles

It’s important to note that this closing fee is also sometimes referred to as a “variable” fee, as in the past, it was charged as a percentage of the sale price on Amazon. However, the current closing fee structure is a fixed $1.80 per item sold in the eligible media categories.

Account or Subscription Fee

1. Individual seller per-item fee

Individual sellers pay a flat $0.99 for each sales transaction in lieu of a monthly subscription fee.

Like referral fees, these fees are deducted only after a sale is made on Amazon. They are then subtracted from the amount Amazon places into your Amazon account balance.

You do not have to pay the fee upfront.

2. Professional seller subscription fee

Professional sellers pay a monthly subscription fee of $39.99, which replaces the $0.99 per-item fee charged to individual sellers. This subscription fee is deducted from the seller’s Amazon account balance. If you’re selling 40 or more items per month, a Professional account becomes more cost-effective than an Individual account.

If you don’t have funds in your account, then the amount is deducted from your credit card.

3. Refund administration fees

If a shopper requests a refund on a product for which you have already been paid and Amazon issues the refund, Amazon charges a fee to process it. The cost is either $5.00 or 20% of the refunded charge, whichever is less.

As with the other fees mentioned, refund administration fees are immediately paid through your Amazon account balance or charged to your credit card if your account doesn’t have the money to cover them.

All in One Software

for Book Sellers

Scout Better – List Faster – Reprice Smarter

Over 30% Business Growth

Achieved by Our Clients

Other Amazon fees that sellers should keep in mind

Sellers should be aware of other Amazon fees, such as:

Long-Term Storage Fees

Amazon charges additional fees for inventory stored in its fulfillment centers for more than 6-12 months. Depending on the product type and storage duration, the fees range from $0.50 to $6.90 per cubic foot per month.

Removal/Disposal Fees

If you need to remove or dispose of inventory from Amazon’s warehouses, there are associated fees. Removal fees range is $0.25 and up per unit(around $2 on average), depending on item size and shipping method.

High-Volume Listing Fees

After the first 100,000 listings, Amazon charges a monthly fee of $0.005 per eligible listing (exluding listings in media categories) that has not sold in the last 12 months. This encourages sellers to maintain an active, high-selling product catalog.

By understanding these FBA fees, sellers can optimize their inventory management strategies, minimize costs, and maintain profitability in their Amazon businesses. Regularly monitoring fee changes and their impact on specific product categories is crucial for long-term success.

Refund Administration Fees

- When you refund a customer, Amazon will refund the referral fee minus a refund administration fee.

- This fee is $5 or 20% of the referral fee, whichever is less.

Other Miscellaneous Fees

- Amazon may charge fees for services like gift wrapping, product prep, and removal of hazardous materials.

- Fees can also apply for things like customer service errors, damaged/lost inventory, and more.

How to calculate FBA fees?

Understanding the associated fees is essential to ensuring profitability when using Amazon FBA (Fulfillment by Amazon)—the main Amazon FBA fees to calculate include fulfillment fees, storage fees, and other miscellaneous fees.

Fulfillment Fees

Amazon charges per-unit fees for picking, packing, and shipping orders. Fees depend on product size, weight, and category. Current rates are available on Amazon’s website and are subject to change.

Storage Fees

Amazon charges monthly storage fees based on inventory volume (cubic feet) and duration in fulfillment centers. Fees vary by product type and time of year, with higher rates during Q4. Monitor inventory levels to minimize storage costs.

Other Fees

- Referral fees: 8-15% of total sales price per unit sold

- Closing fees: Small per-unit fee for specific categories like media items

- Removal/disposal fees: If inventory is removed or disposed of by Amazon

Calculating Total FBA Fees

- Determine product dimensions, weight, and category.

- Look up corresponding fulfillment, storage, and other fees

- Factor in product sales price and expected volume

Stay informed on FBA fees to optimize pricing and profit margins for your Amazon business.

Monitor changes to ensure ongoing profitability.

How can this affect sellers?

Sellers must adapt to 2024 FBA fee increases by carefully managing costs, operations, and tactics to maintain Amazon’s profitability. Increased fulfillment fees for some sizes, new inventory placement and storage fees necessitate better inventory planning and tracking.

Operational challenges include optimizing inventory levels to avoid storage overage fees, accurately measuring products to adapt to size tier changes, and avoiding incorrect FBA fees. Smaller sellers may struggle the most with fee increases.

Some relief: referral fees for apparel under $20 decrease. The new Amazon Vine program fee structure may make product reviews more affordable. Expanded services like FBA New Selection and Supply Chain by Amazon provide benefits for eligible sellers.

Why Use Amazon FBA for Your Business?

Amazon FBA (Fulfillment by Amazon) can greatly improve your business operations and customer satisfaction. FBA helps increase sales and customer loyalty, offers logistical and fulfillment advantages, enhances operational efficiency, and supports global expansion.

Increased Sales and Customer Loyalty

- FBA products are eligible for Amazon Prime free shipping, which can boost sales as over 80% of Amazon sales go through the Prime-eligible Buy Box.

- Prime customers spend more on average than non-prime customers, so FBA can help you reach this valuable customer base.

- FBA handles customer service and returns processing, improving the overall customer experience.

Logistics and Fulfillment Advantages

- Amazon’s vast fulfillment network and logistics expertise allow FBA sellers to offer fast, reliable shipping without the hassle of managing their warehousing and shipping.

- FBA provides discounted shipping rates that are often lower than what sellers could negotiate on their own.

- Unlimited storage space in Amazon’s warehouses is especially beneficial for high-volume sellers.

Operational Efficiency

- FBA handles the entire order fulfillment process, from storage to packing and shipping, freeing sellers to focus on growing their business.

- Amazon’s 24/7 customer support for FBA sellers helps manage customer inquiries and returns.

- Automated inventory management and reporting through the Seller Central dashboard.

Global Expansion

- FBA’s international fulfillment capabilities allow sellers to easily expand to new Amazon marketplaces worldwide.

- The FBA Export program handles customs clearance and international shipping for cross-border sales.

Overall, the search results indicate that Amazon FBA can be a valuable service for many sellers, providing logistics support, sales growth opportunities, and operational efficiencies that can help businesses scale. However, the costs and operational requirements of FBA must also be carefully evaluated to ensure it is the right fulfillment solution.

Take Your Amazon Business To New Heights With Bookz Pro

Amazon Book Reselling Blueprint

Read now, explore our full guide. Your revolution starts here. Subscribe to get the blueprint!

Bookz Pro is the ultimate software solution designed to streamline your operations and drive growth. With ultra-fast listings, built-in repricing, and comprehensive inventory management, Bookz Pro helps you list more products, optimize pricing, and maintain precise stock levels. User-friendly interface save you time and enhance efficiency. Plus, if you need guidance for your book reselling business, download our blueprint for free.

Conclusion

Understanding Amazon FBA fees is crucial for any seller aiming to maintain profitability while leveraging the benefits of the Fulfillment by Amazon program. Despite the complexities and costs associated with referral fees, fulfillment fees, storage fees, and other miscellaneous charges, the FBA program offers significant advantages, such as access to Amazon Prime customers, efficient logistics, and expansive market reach.

Sellers can handle these costs well by keeping up to date on the latest fee structures and making smart choices about inventory and prices. Finding the right balance between these fees and the practical benefits that FBA offers is the key to success in the competitive Amazon market.

Frequently Asked Questions

Yes, oversized items incur higher fulfillment and storage fees due to their size and weight. It’s important to check Amazon’s fee structure for detailed rates.

Yes, FBA fulfillment fees for apparel are different based on the size and weight of the items. Amazon updated these fees as of 2024.

If a shopper requests a refund on a product for which you have already been paid and Amazon issues the refund, Amazon charges a fee to process it. The cost is either $5.00 or 20% of the refunded charge, whichever is less.

To calculate Amazon FBA fees, determine your product’s dimensions, weight, and category. Look up the corresponding fulfillment, storage, and referral fees on Amazon’s website. Factor in your product’s sales price and expected volume. Add up all applicable fees to get the total FBA cost per unit.

Amazon FBA fees include fulfillment fees (for picking, packing, and shipping), storage fees (based on inventory volume), referral fees (a percentage of the sale price), and other miscellaneous fees such as long-term storage, removal/disposal, and high-volume listing fees.

Amazon FBA fees vary widely depending on product characteristics. Fulfillment fees range from $3.22 to over $194.95 per unit. Storage fees can be $0.50 to $6.90 per cubic foot per month. Referral fees are typically 15% of the sale price but can range from 8% to 45% depending on the category.

To reduce Amazon FBA fees, optimize product packaging to minimize size and weight, manage inventory levels to avoid long-term storage fees, use Amazon’s Ships in Product Packaging (SIPP) program when eligible, consider switching to a Professional seller account if selling over 40 items per month, and regularly review and adjust your pricing strategy.

Understanding Amazon FBA fees is crucial for maintaining profitability and making informed decisions about your Amazon selling strategy. Proper knowledge of these fees can help you optimize your operations, inventory management, and pricing strategies to ensure business success.