Amazon Small Business Lending: A Smart Financing Option for Sellers in 2025

Launching and scaling an online business can be exciting, but it often comes with financial challenges, especially when it’s time to invest in more inventory or expand operations. That’s where Amazon is stepping up to support its seller community. In recent years, Amazon has shown a strong commitment to helping small businesses succeed, not just by providing a massive selling platform, but also by offering tools and services tailored to their growth.

One standout resource gaining traction is Amazon Small Business Lending. Designed to give eligible sellers quick access to working capital, this financing option is becoming an increasingly popular way for Amazon sellers to scale without turning to traditional banks. Whether you’re looking to stock up for Q4 or launch a new product line, Amazon’s lending program could be the financial boost your business needs.

What Is Amazon Small Business Lending?

Amazon Small Business Lending is a financing program created specifically for Amazon sellers who need quick and convenient access to capital. Whether you’re looking to expand your inventory, invest in marketing, or cover seasonal expenses, this program is designed to help small business owners grow directly through the Amazon platform.

Amazon partners with financial institutions like Marcus by Goldman Sachs, Lendistry, and other lenders to offer a variety of financing options tailored to sellers’ needs. These options typically include:

- Term Loans – Fixed-rate loans with a set repayment schedule, ideal for larger, one-time investments like bulk inventory purchases.

- Lines of Credit – Flexible access to funds up to a certain limit, which you can draw from as needed—great for managing cash flow.

- Merchant Cash Advances – Funding based on your future sales, with repayments made automatically as a percentage of your daily revenue.

One key detail: this program is invite‑only. You won’t find an open application form on Amazon. Instead, Amazon uses your seller data—like account health, sales volume, customer feedback, and performance history—to determine your eligibility. If you qualify, you’ll receive a loan offer directly in your Seller Central dashboard, where you can review the terms and accept the offer if it fits your needs.

By leveraging the data already available through your seller account, Amazon simplifies the approval process and helps reduce the barriers to getting the funds you need—no paperwork, no long waits.

Benefits of Amazon Small Business Lending

Amazon Small Business Lending is built with busy sellers in mind, offering a streamlined and hassle‑free way to secure funding. Here are some of the standout benefits that make it an attractive option:

1. Quick Access to Capital

One of the biggest advantages is how fast and easy it is to get funding. There’s no need to fill out complicated forms or wait weeks for approval. If you’re eligible, Amazon sends the offer directly to your Seller Central account. Accept it with just a few clicks, and the funds are typically deposited into your account within days.

2. No Impact on Your Credit Score

Worried about your credit? You don’t have to be. Since the program is based on your seller performance rather than a traditional credit check, simply receiving or reviewing a loan offer from Amazon won’t affect your credit score. This makes it a low-risk way to explore your financing options.

3. Automated Repayment Through Sales

Repayment is refreshingly simple. Amazon automatically deducts a percentage of your sales revenue to pay back the loan. This ensures you’re not stuck with fixed monthly payments during slow sales periods, helping you manage your cash flow more easily.

4. Competitive Interest Rates

Compared to traditional bank loans or credit cards, Amazon’s lending options typically come with competitive interest rates, especially considering the convenience and speed of the process. Since Amazon already has insight into your business performance, it can offer personalized rates that reflect your success on the platform.

Who Is Eligible?

Amazon Small Business Lending isn’t open to just anyone—it’s a by-invitation-only program designed to support sellers who’ve demonstrated strong performance on the platform. If you’re wondering whether you qualify, here’s how Amazon typically determines eligibility:

1. Performance-Based Criteria

Amazon uses a combination of internal metrics to evaluate its business. While there’s no publicly listed formula, eligibility is generally based on:

- Sales Volume – Consistent and growing sales indicate that your business is stable and capable of repaying a loan.

- Account Health – Good standing with Amazon, including low defect rates, timely shipping, and strong customer feedback, boosts your chances.

- Selling History – A longer, reliable selling track record with Amazon gives lenders more confidence in your performance and repayment reliability.

2. Personalized, Data-Driven Offers

Instead of asking you to apply, Amazon proactively reviews your account data and, if you meet the criteria, will present you with a financing offer. These offers are tailored to your business’s performance and are designed to match your capacity to repay comfortably.

3. Delivered Directly Through Seller Central

If you’re eligible, you’ll see a loan offer directly within your Seller Central dashboard. From there, you can review the terms, compare options (if available), and accept the offer—all in just a few clicks.

So, if you’re actively selling on Amazon and keeping your account in good shape, there’s a solid chance you’ll receive a lending offer as your business grows.

How the Application and Approval Process Works

One of the biggest advantages of Amazon Small Business Lending is how simple and fast the entire process is. Unlike traditional loans that require lengthy forms and waiting periods, Amazon makes accessing funds as seamless as possible.

1. Receiving the Loan Offer

If your business is eligible, Amazon will send you a loan offer directly through your Seller Central dashboard. There’s no need to apply—Amazon evaluates your account in real time based on performance metrics like sales history and account health.

When you receive an offer, you’ll find it in the “Growth Opportunities” or “Seller Financing” section. You’ll see the loan amount, repayment terms, interest rate, and estimated daily payment based on your current sales.

2. Accepting the Offer

If the terms look good to you, accepting is just a matter of clicking a few buttons. There’s no paperwork to fill out or external credit checks to worry about. Once you click “Accept,” you’ll confirm your bank details and digitally sign the agreement.

3. Funding Timelines

- After accepting, funds are typically deposited into your business bank account within 1 to 5 business days—often much faster than traditional lending options. You can then use the capital however you choose, whether for restocking inventory, launching ads, or expanding your product line.

4. Easy, Automated Repayment

Repayment is equally smooth. Amazon deducts a fixed percentage or set amount (depending on the loan type) directly from your daily or weekly sales revenue. This automation ensures you never miss a payment and helps you manage cash flow more predictably.

With no lengthy applications, no credit score impact, and fast funding, Amazon’s lending process is designed to keep you focused on growing your business, not stuck in paperwork. It’s a financing solution that works at the speed of e-commerce.

Pros and Cons to Consider

Amazon Small Business Lending offers a reliable and user-friendly financing solution for sellers who need extra capital to grow. Like any financial tool, it’s important to understand both the advantages and the considerations so you can make an informed decision.

Key Advantages

- Seamless Access to Funds

There’s no lengthy paperwork or traditional application process. If your account qualifies, the offer appears right in your Seller Central dashboard, making the process simple and fast. - Effortless Repayment

Repayments are automatically deducted from your sales revenue, so you can stay focused on running your business without managing separate due dates or invoices. - No Collateral Needed

Amazon’s lending program doesn’t require you to put up business or personal assets as security, which makes it a more accessible option for many small sellers.

Considerations to Keep in Mind

- Available by Invitation Only

To maintain a seamless and secure experience, Amazon uses performance data to offer loans selectively. This ensures that funding is extended to sellers who are ready for it, though it means not everyone will see an offer. - Set Loan Terms

Offers are designed based on your seller data and come with predefined terms. While convenient, this means there’s less flexibility in customizing repayment structures. - Sales-Based Repayment Model

Repayments are tied to your Amazon sales, which is great for aligning payments with business performance. However, it’s worth planning to manage cash flow during slower periods.

Who Can Benefit Most?

This lending option is especially valuable for sellers with steady sales performance who are ready to take the next step in scaling their Amazon business. It’s a smart fit for those who want fast, low-effort access to capital without the hurdles of traditional financing.

How to Increase Your Chances of Getting an Amazon Loan Offer

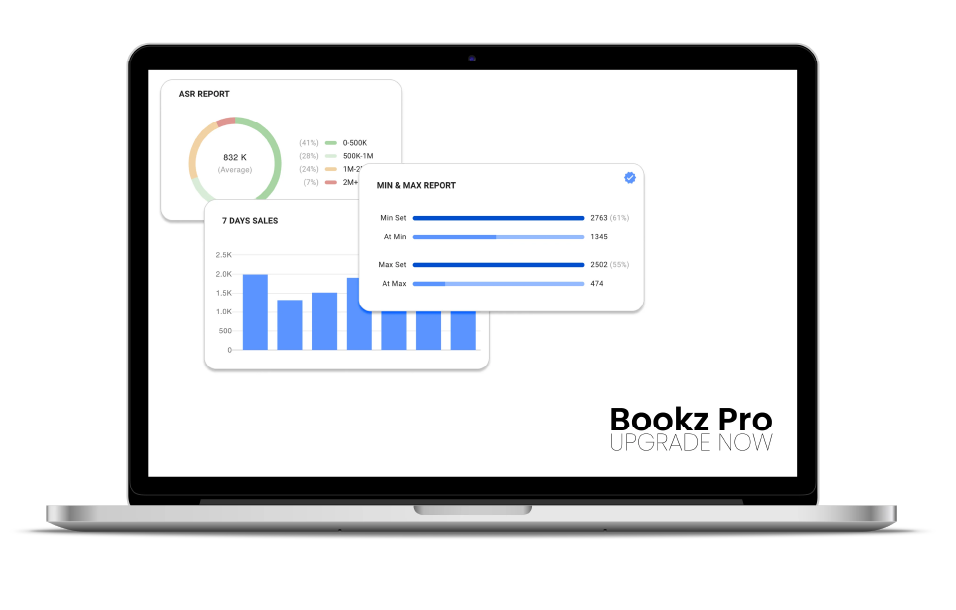

All in One Software

for Book Sellers

Scout Better – List Faster – Reprice Smarter

Over 30% Business Growth

Achieved by Our Clients

Since Amazon Small Business Lending is an invite-only program, the best way to qualify is to focus on strengthening your overall seller performance. Amazon uses a variety of internal metrics to determine eligibility, so consistently maintaining a healthy, high-performing account will increase the likelihood of receiving a loan offer.

Here are some practical ways to improve your chances:

1. Optimize Your Seller Performance Metrics

Amazon closely monitors performance indicators like order defect rate, late shipment rate, and pre-fulfillment cancel rate. Keeping these as low as possible signals that you’re running a reliable and trustworthy business. Use Seller Central’s Performance Dashboard to track and improve these metrics regularly.

2. Maintain Excellent Account Health

Account health plays a major role in eligibility. To stay in good standing:

- Ship orders on time or ahead of schedule

- Keep your inventory updated to avoid cancellations

- Respond promptly to customer messages

- Resolve A-to-Z Guarantee claims quickly and fairly

A consistently strong account record shows Amazon that you’re a stable seller worth investing in.

3. Boost Sales Velocity

Higher and more consistent sales can positively impact your loan eligibility. Strategies to improve sales velocity include:

- Running promotions or Lightning Deals

- Optimizing product listings with better keywords, images, and pricing

- Expanding your product range or restocking popular items

More frequent and higher-value transactions demonstrate growth potential, which Amazon looks for when making lending decisions.

4. Focus on Customer Satisfaction

Positive feedback, high star ratings, and low return rates are all signals of customer satisfaction—and they’re factored into your performance profile. Encourage happy customers to leave reviews and resolve any issues quickly to avoid negative ratings.

By taking these steps, you not only improve your chances of receiving a lending offer but also strengthen the foundation of your business overall. Amazon rewards sellers who consistently meet high standards, and that includes offering access to growth-focused tools like small business financing.

Fuel Your Growth with Bookz Pro!

Amazon Book Reselling Blueprint

Read now, explore our full guide. Your revolution starts here. Subscribe to get the blueprint!

Amazon Small Business Lending gives you the capital. Bookz Pro helps you put it to work efficiently. From smarter inventory management to faster listing and order processing, Bookz Pro is designed to help Amazon sellers stay organized and scale without added stress.

Sign up today and get a free blueprint filled with proven techniques and beginner-friendly strategies to help you source, list, and scale faster. Start selling smarter with Bookz Pro—your journey to Amazon success starts now.

Conclusion

Amazon Small Business Lending is a convenient and accessible financing option designed to help sellers grow with minimal hassle. With quick funding, automated repayments, and no collateral required, it’s a smart solution for those who qualify. To make the most of this opportunity, regularly check your Seller Central dashboard for offers and maintain strong performance metrics. As with any financial decision, be sure to borrow responsibly and align any funding with your long-term business goals.

Frequently Asked Questions

Yes, Amazon offers small business loans through its Amazon Lending program. Loans are by invitation only and based on seller performance.

Eligibility is by invitation only. Amazon evaluates seller performance, account health, and sales history before offering financing options through the platform.

Loan amounts typically range from $1,000 to $750,000, depending on your account performance and sales metrics.

If you’re eligible, you’ll see an invitation in your Seller Central dashboard. Amazon Lending does not accept external applications.

Yes. Many sellers use the funds to restock high-demand products, invest in seasonal inventory, or scale up operations quickly.